I’m Jay Kent, managing director of SLB Performance, a consulting firm that helps companies reduce supply chain costs, implement BI tools, and improve in-stocks and customer service. After 25 years of leading some of the most complex supply chains in the industry, I began advising companies in multiple industries and verticals. To mitigate costs and improve efficiencies, it’s important to understand the market. So twice a month, I’ll share parcel news and thoughts. Be sure to hit the subscribe button to receive the latest newsletter in your LinkedIn notifications.

FedEx continues to shrink its network to match market demand while holding tight to its revenue management practices. Will it be enough as we head into the year’s second half, or are more customers turning to other less expensive carriers and providers and last-mile services such as BOPIS and curbside pickups?

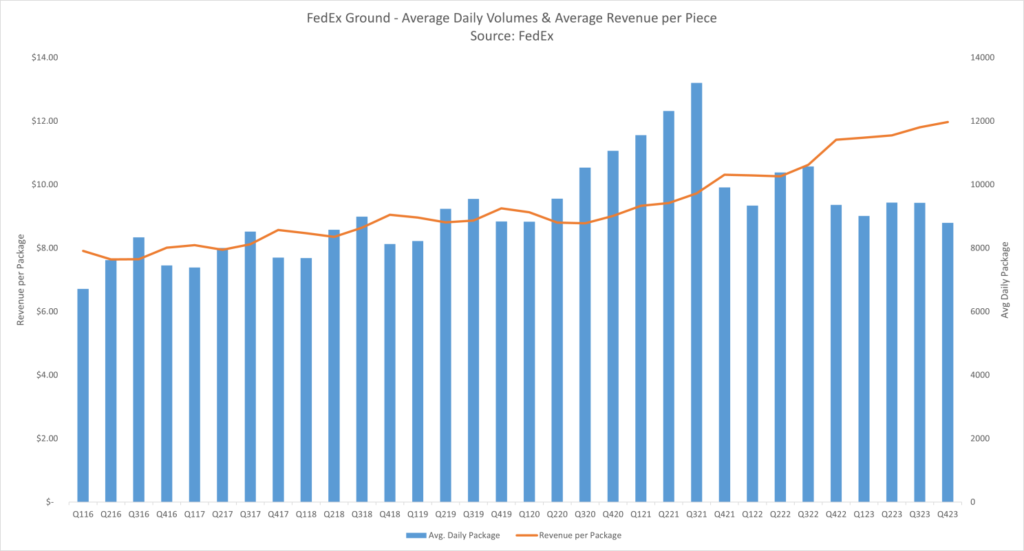

FedEx announced Q4 earnings last night, and not surprisingly, revenue and volume declined across the board. Even though FedEx Ground also reported declines in revenue and volume, it was the only division to report positive operating income growth, which increased by 18% due to higher revenue per package and cost-reduction actions.

- “At FedEx Ground, fourth-quarter revenue was down 2% year-over-year, driven by a 6% decline in volume, partially offset by a 5% increase in yield due to surcharges and product mix. We once again delivered strong service levels and best-in-class market transits,” FedEx’s CCO Brie Carere told analysts.

FedEx also announced that FedEx Ground operations and personnel in Canada will transition to FedEx Express Canada starting in April 2024.

Also during the fourth quarter, FedEx introduced a new returns program – FedEx consolidated returns – available at FedEx office locations. According to Carere, “It’s a low-cost e-commerce solution for lightweight apparel returns with end-to-end visibility. For shoppers, it’s a convenient, no-label, no-box drop-off experience using a QR code.”

Other tidbits from the FedEx earnings call:

- “In Q4, we did not see any material benefit because of those discussions [with UPS customers], and we have not planned for any benefit moving into fiscal year ‘24. What I can tell you is that this has opened a lot of doors. We’re having a lot of great conversations with legacy UPS customers, and we feel really strong — we feel really good about the sales pipeline because of the strong value proposition we have versus our primary competitor.” – FedEx CCO Brie Carere

- “We are still seeing consumer strengths here in the United States, but we are seeing an e-commerce reset. So from a green shoots perspective, one of the things that we’re going to be looking at is e-commerce growth, it’s sitting at 7% to 8%. It’s important to note our percentage of that is closer to 2% to 3% because we don’t play in grocery, and obviously, within that 7% to 8% is also buy online, pickup in-store, so we will be keeping an eye on that consumer strength here in the United States and would love to see, as we head into peak, a little bit of a different shift. We have not seen that yet, but we’ll be watching for it.” – FedEx CCO Brie Carere

In other parcel news…

Regional parcel carrier GLS has expanded beyond its nine-state western network to serve Texas, Chicago, Atlanta and Columbus, Ohio, with plans to expand its capabilities within those four areas. According to President Steven Bergan, GLS partners with LTL carriers Averitt Express and Custom Companies to handle the first and middle miles itself and inject parcels into partner networks in the added states. Partners include Courier Express in Georgia, LSO in Texas, UDS in Illinois, and Better Trucks in Ohio.

Surveys

- “Seventy-nine percent of respondents considered last-mile services very or extremely important to providing a competitive edge. Even if consumer spending is dropping, these last-mile needs will not go away,” said Jim Waters, vice president of marketing for Frayt.

- Faster delivery is retailers’ primary differentiating strategy: 72% of retailers plan to invest in two-day delivery over the next two years. In the short-term, nearly two-thirds (60%) plan to offer two-day shipping as their standard delivery commitment during the 2023 peak season, up 11% from 2022. According to a new study by leading e-commerce parcel carrier OnTrac.

- 43% of consumers felt retailers were doing a good job of using sustainable delivery practices. Over 60%, however, indicated in the study published by Descartes Systems Group Inc. that they were very interested in environmentally friendly delivery methods.

That’s it for now. Comments are always welcome. Let me know what I missed. Stay tuned for the next newsletter on July 12, and don’t forget to hit the subscribe button to ensure you receive it in your LinkedIn notices.

-Jay